All Categories

Featured

Table of Contents

- – All-In-One Tax Sale Overage List System Tax Ov...

- – World-Class Tax Overages Learning Bob Diamond ...

- – Five-Star Best States For Tax Overages Bluepr...

- – Well-Regarded Tax Overages Program Tax Auctio...

- – Reputable Mortgage Foreclosure Overages Trai...

- – Exclusive Foreclosure Overages List Program ...

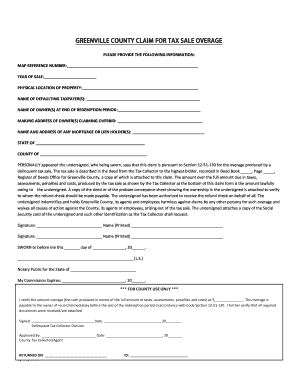

All claims have to be submitted not behind one year from the day the tax action is tape-recorded or else the claim can not be taken into consideration. There are no exceptions to the one-year duration to submit a claim. No honor resolutions will certainly be made till after the one year filing duration has ended.

Any kind of action or continuing to challenge the award choice should be started within 90 days after the day of the decision. If unclaimed excess profits continue to be at the end of one year after the recordation date of tax obligation action to purchaser, the tax obligation enthusiast may deduct the expense of preserving the redemption and tax-defaulted residential property documents that was not recouped and/or deposit the excess unclaimed proceeds into the region basic fund.

Excess funds are not distributed to third parties by this office unless that third celebration is a certified lawyer for the plaintiff. Bob Diamond Tax Overages Blueprint. Lawyers require to provide their state bar number as verification. The Tax obligation Commissioner's Workplace does not recognize a lawful relationship of "depiction" by an asset recoup company, neither by a person that has been approved Power of Lawyer

Insurance claims by lien owners have to include a present payoff declaration. Civil liberties to excess funds are controlled and developed by state regulation which establishes the priority of liens and which ones earn money first. All claims and excess funds of $100,000 and over will instantly be interplead with the premium court for the most part.

All-In-One Tax Sale Overage List System Tax Overages Business Opportunities

Due to natural changes in organization, we will certainly offset your overages to a shortage that falls the month before or after the scarcity during an audit. Any scarcity not covered by an excess will result in additional tax when an audit of your records is finished.

The proprietor of document quickly prior to the end of redemption period should sign the arrangement and release kind. If there are numerous owners, all have to authorize.

Driver Certificate or other Photo I.D. of ALL Plaintiff(s). The Delinquent Tax obligation Collection agency will certainly validate the quantity of the overage and validate the identification of the complaintant(s). If there is any question about the accuracy of the plaintiff(s), they will certainly be called for to get a court order to acquire the excess.

World-Class Tax Overages Learning Bob Diamond Tax Overages Blueprint

These amounts are payable ninety (90) days after implementation of the act unless a judicial action is instituted during that time by an additional claimant. If neither declared neither designated within five years of the day of public auction tax sale, the excess will escheat to the general fund of the controling body.

If you have any type of inquiries, please contact Overdue Tax obligation at 803-245-3009. The details on this website is made readily available as a public solution and is to be utilized for recommendation objectives only. The Overdue Tax Enthusiast strives to give one of the most exact info feasible. However, parts of details may be inaccurate or obsolete, and Bamberg Area does not assure, either expressly or by implication, the precision, integrity, or timeliness of any kind of details on this internet site.

Five-Star Best States For Tax Overages Blueprint Tax Deed Overages

If numerous individuals are detailed as the owners, after that the check will certainly be detailed in all of the owners' names, or issued to an estate, if the estate was the last owner of document.

Figure out info pertaining to the York County Council Complete our on-line FOIA application. Objective and Vision Statement of York County Pennies for Progress is the name of the York Area Resources Projects Sales and Utilize Tax Obligation Programs. Gain an understanding of the plans for York Area from the Area Council and Area Manager.

There may arise many and conflicting claims for these funds. Please be aware that in the occasion of clashing claims, the funds may be placed in Superior Court of Chatham County through an interpleader action so that a judge might determine that the rightful person to get these funds might be.

When funds have been placed right into Superior Court, the plaintiff will need to speak to Superior Court at ( 912) 652-7200 with any type of inquiries. The Tax obligation Commissioner's Office will not have information on the funds or their dispensation. Excess funds go through priority claim by the mortgagee or protection interest owner.

Well-Regarded Tax Overages Program Tax Auction Overages

To receive factor to consider, all insurance claims must consist of the following: that has been finished and signed by the prospective plaintiff of the funds. Image recognition Justification and proof of ownership of the excess funds It is the plan of the Tax Commissioner's Office that all checks are made payable to the proprietor, protection deed holder or lien holder of the funds just, not to a 3rd event.

Excess earnings from the sale of tax-defaulted building is specified as any type of quantity that mores than the minimum quote rate. Events having a possession or lien holder rate of interest in the home at the time the property is marketed at tax sale have a right to file a case for any type of excess profits that continue to be.

Reputable Mortgage Foreclosure Overages Training Foreclosure Overages

Complying with a tax sale, any type of excess of funds, known as 'excess funds,' is put in a separate account. Claim forms have to be returned to the tax obligation commissioner's office finished in their whole and in an unchanged state.

Claim forms are declined from 3rd parties, other than in the situation of a lawyer who is legally standing for the claimant in the issue. The tax obligation commissioner's office does not identify a legal partnership of "representation" by a possession healing company, nor by an individual who has actually been provided Power of Lawyer.

If even more than one claim is gotten, a judge may determine that will certainly receive the funds. Any kind of necessary legal evaluation of excess funds claims will certainly influence the timing of the payment of those funds. Repayment of excess funds will be made and sent out only to the record owner of the residential or commercial property, or to various other events having a lien owner interest at the time of the tax sale.

Exclusive Foreclosure Overages List Program Tax Sale Overages

Tax liens and tax obligation acts often offer for higher than the region's asking rate at auctions. On top of that, most states have regulations impacting proposals that exceed the opening proposal. Repayments over the area's criteria are referred to as tax sale excess and can be profitable financial investments. The information on excess can develop troubles if you aren't conscious of them.

Table of Contents

- – All-In-One Tax Sale Overage List System Tax Ov...

- – World-Class Tax Overages Learning Bob Diamond ...

- – Five-Star Best States For Tax Overages Bluepr...

- – Well-Regarded Tax Overages Program Tax Auctio...

- – Reputable Mortgage Foreclosure Overages Trai...

- – Exclusive Foreclosure Overages List Program ...

Latest Posts

Is Buying Tax Lien Certificates A Good Investment

Tax Delinquent Property Sales

City Tax Auction

More

Latest Posts

Is Buying Tax Lien Certificates A Good Investment

Tax Delinquent Property Sales

City Tax Auction